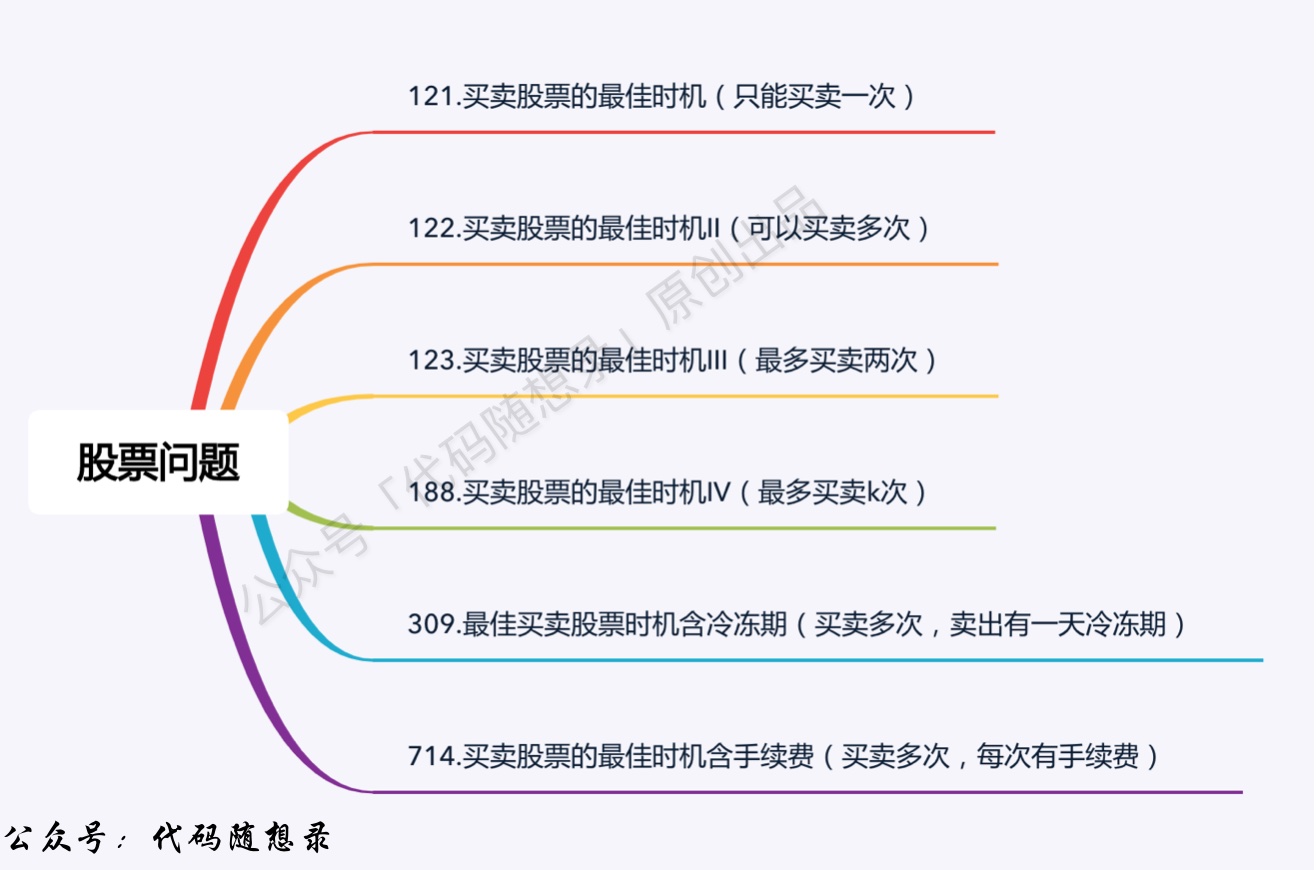

# Summary of LeetCode Stock Problems!

Previously, we have gone through the series of stock problems on LeetCode, but we haven't had a summary to give everyone a high-level overview, so here it comes!

- Dynamic Programming: 0121.Best Time to Buy and Sell Stock (opens new window)

- Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window)

- Dynamic Programming: 0123.Best Time to Buy and Sell Stock III (opens new window)

- Dynamic Programming: 0188.Best Time to Buy and Sell Stock IV (opens new window)

- Dynamic Programming: 0309.Best Time to Buy and Sell Stock with Cooldown (opens new window)

- Dynamic Programming: 0714.Best Time to Buy and Sell Stock with Transaction Fee (Dynamic Programming) (opens new window)

# Best Time to Sell Stock

Dynamic Programming: 0121.Best Time to Buy and Sell Stock (opens new window), you can only buy and sell once, ask for maximum profit.

【Greedy Solution】

Take the smallest value on the left, and the largest value on the right, then the difference obtained is the maximum profit, the code is as follows:

class Solution {

public:

int maxProfit(vector<int>& prices) {

int low = INT_MAX;

int result = 0;

for (int i = 0; i < prices.size(); i++) {

low = min(low, prices[i]); // Take the minimum price on the left

result = max(result, prices[i] - low); // Directly take the maximum interval profit

}

return result;

}

};

2

3

4

5

6

7

8

9

10

11

12

【Dynamic Programming】

dp[i][0]means the cash obtained on day i when holding the stock.dp[i][1]means the cash obtained on day i when not holding the stock.

If holding the stock on day i, i.e., dp[i][0], it can be derived from two states:

- Holding the stock on day i-1, that means keep the status quo, and the cash obtained is the cash from holding the stock yesterday:

dp[i - 1][0] - Buy the stock on day i, the cash obtained is the cash after buying the stock today:

-prices[i]Sodp[i][0] = max(dp[i - 1][0], -prices[i]);

If not holding the stock on day i, i.e., dp[i][1], it can also be derived from two states:

- Not holding the stock on day i-1, that means keep the status quo, and the cash obtained is the cash from not holding the stock yesterday:

dp[i - 1][1] - Sell the stock on day i, the cash obtained is the cash after selling the stock at today's price:

prices[i] + dp[i - 1][0]Sodp[i][1] = max(dp[i - 1][1], prices[i] + dp[i - 1][0]);

The code is as follows:

// Version one

class Solution {

public:

int maxProfit(vector<int>& prices) {

int len = prices.size();

if (len == 0) return 0;

vector<vector<int>> dp(len, vector<int>(2));

dp[0][0] -= prices[0];

dp[0][1] = 0;

for (int i = 1; i < len; i++) {

dp[i][0] = max(dp[i - 1][0], -prices[i]);

dp[i][1] = max(dp[i - 1][1], prices[i] + dp[i - 1][0]);

}

return dp[len - 1][1];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

- Time Complexity: O(n)

- Space Complexity: O(n)

Using Rolling Array, the code is as follows:

// Version two

class Solution {

public:

int maxProfit(vector<int>& prices) {

int len = prices.size();

vector<vector<int>> dp(2, vector<int>(2)); // Note that here only a 2 * 2 array is opened

dp[0][0] -= prices[0];

dp[0][1] = 0;

for (int i = 1; i < len; i++) {

dp[i % 2][0] = max(dp[(i - 1) % 2][0], -prices[i]);

dp[i % 2][1] = max(dp[(i - 1) % 2][1], prices[i] + dp[(i - 1) % 2][0]);

}

return dp[(len - 1) % 2][1];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

- Time Complexity: O(n)

- Space Complexity: O(1)

# Best Time to Buy and Sell Stock II

Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window) allows multiple trades, asking for maximum profit.

【Greedy Solution】

Collect positive profits each day, the code is as follows:

class Solution {

public:

int maxProfit(vector<int>& prices) {

int result = 0;

for (int i = 1; i < prices.size(); i++) {

result += max(prices[i] - prices[i - 1], 0);

}

return result;

}

};

2

3

4

5

6

7

8

9

10

- Time Complexity: O(n)

- Space Complexity: O(1)

【Dynamic Programming】

Definition of dp array:

dp[i][0]means the cash obtained on day i when holding the stock.dp[i][1]means the cash obtained on day i when not holding the stock.

If holding the stock on day i, i.e., dp[i][0], it can be derived from two states:

- Holding the stock on day i-1, that means keep the status quo, and the cash obtained is the cash from holding the stock yesterday:

dp[i - 1][0] - Buy the stock on day i, the cash obtained is the cash from not holding the stock yesterday minus the stock price today:

dp[i - 1][1] - prices[i]

Note the only difference here from 0121. Best Time to Buy and Sell Stock (opens new window) is when deriving dp[i][0], it's about buying the stock on day i.

In 0121. Best Time to Buy and Sell Stock (opens new window), since the stock can only be traded once overall, if buying a stock, then holding the stock on day i, i.e., dp[i][0] must be -prices[i].

In this problem, since a stock can be traded multiple times, the cash obtained after buying the stock on day i may include the profits from previous trades.

The code is as follows (note the comments in the code, marking the only difference from 0121. Best Time to Buy and Sell Stock (opens new window)):

class Solution {

public:

int maxProfit(vector<int>& prices) {

int len = prices.size();

vector<vector<int>> dp(len, vector<int>(2, 0));

dp[0][0] -= prices[0];

dp[0][1] = 0;

for (int i = 1; i < len; i++) {

dp[i][0] = max(dp[i - 1][0], dp[i - 1][1] - prices[i]); // Note this is the only difference from 121. Best Time to Buy and Sell Stock.

dp[i][1] = max(dp[i - 1][1], dp[i - 1][0] + prices[i]);

}

return dp[len - 1][1];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

- Time Complexity: O(n)

- Space Complexity: O(n)

# Best Time to Buy and Sell Stock III

Dynamic Programming: 0123.Best Time to Buy and Sell Stock III (opens new window) at most allows two trades, asking for maximum profit.

【Dynamic Programming】

A total of five states are available per day,

- No operation

- First buy

- First sell

- Second buy

- Second sell

dp[i][j] where i indicates the ith day, j [0 - 4], dp[i][j] represents the maximum cash left on day i with state j.

To reach state dp[i][1], there are two specific operations:

- Operation one: stock is bought on day i, then

dp[i][1] = dp[i-1][0] - prices[i] - Operation two: there is no operation on day i, and the state from the previous day where the stock was bought is retained, i.e.,

dp[i][1] = dp[i - 1][1]

dp[i][1] = max(dp[i-1][0] - prices[i], dp[i - 1][1]);

Similarly, dp[i][2] also has two operations:

- Operation one: stock is sold on day i, then

dp[i][2] = dp[i - 1][1] + prices[i] - Operation two: there is no operation on day i, retain the state from the previous day where the stock was sold, i.e.,

dp[i][2] = dp[i - 1][2]

So dp[i][2] = max(dp[i - 1][1] + prices[i], dp[i - 1][2])

Similarly, the remaining states can be derived:

dp[i][3] = max(dp[i - 1][3], dp[i - 1][2] - prices[i]);

dp[i][4] = max(dp[i - 1][4], dp[i - 1][3] + prices[i]);

The code is as follows:

// Version one

class Solution {

public:

int maxProfit(vector<int>& prices) {

if (prices.size() == 0) return 0;

vector<vector<int>> dp(prices.size(), vector<int>(5, 0));

dp[0][1] = -prices[0];

dp[0][3] = -prices[0];

for (int i = 1; i < prices.size(); i++) {

dp[i][0] = dp[i - 1][0];

dp[i][1] = max(dp[i - 1][1], dp[i - 1][0] - prices[i]);

dp[i][2] = max(dp[i - 1][2], dp[i - 1][1] + prices[i]);

dp[i][3] = max(dp[i - 1][3], dp[i - 1][2] - prices[i]);

dp[i][4] = max(dp[i - 1][4], dp[i - 1][3] + prices[i]);

}

return dp[prices.size() - 1][4];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

- Time Complexity: O(n)

- Space Complexity: O(n × 5)

Certainly, you can see an optimized space solution in the official LeetCode answer; here I provide the corresponding C++ version:

// Version two

class Solution {

public:

int maxProfit(vector<int>& prices) {

if (prices.size() == 0) return 0;

vector<int> dp(5, 0);

dp[1] = -prices[0];

dp[3] = -prices[0];

for (int i = 1; i < prices.size(); i++) {

dp[1] = max(dp[1], dp[0] - prices[i]);

dp[2] = max(dp[2], dp[1] + prices[i]);

dp[3] = max(dp[3], dp[2] - prices[i]);

dp[4] = max(dp[4], dp[3] + prices[i]);

}

return dp[4];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

- Time Complexity: O(n)

- Space Complexity: O(1)

This kind of solution looks simple, but the logic is quite convoluted. It is not recommended to write or think this way, as it can easily confuse oneself! For this problem, understanding how version one is written is enough!

# Best Time to Buy and Sell Stock IV

Dynamic Programming: 0188.Best Time to Buy and Sell Stock IV (opens new window) enables at most k transactions, asking for maximum profit.

Using a two-dimensional array dp[i][j]: the i-th day, state j, the maximum cash left is dp[i][j].

j state representation:

- 0 means no operation

- 1 means first buy

- 2 means first sell

- 3 means second buy

- 4 means second sell

- .....

Except for 0, even numbers mean sell, and odd numbers mean buy.

- Confirm recurrence formula

To reach state dp[i][1], there are two specific operations:

- Operation one: stock is bought on day i, then

dp[i][1] = dp[i - 1][0] - prices[i] - Operation two: no operation on day i, the stock bought state of the previous day is continued, i.e.,

dp[i][1] = dp[i - 1][1]

dp[i][1] = max(dp[i - 1][0] - prices[i], dp[i - 1][1]);

Similarly, dp[i][2] also has two operations:

- Operation one: stock is sold on day i, then

dp[i][2] = dp[i - 1][1] + prices[i] - Operation two: retain the state of selling the stock the day before, i.e.,

dp[i][2] = dp[i - 1][2]

dp[i][2] = max(dp[i - 1][1] + prices[i], dp[i - 1][2])

Similarly, the remaining states can be derived, the code is as follows:

for (int j = 0; j < 2 * k - 1; j += 2) {

dp[i][j + 1] = max(dp[i - 1][j + 1], dp[i - 1][j] - prices[i]);

dp[i][j + 2] = max(dp[i - 1][j + 2], dp[i - 1][j + 1] + prices[i]);

}

2

3

4

The overall code is as follows:

class Solution {

public:

int maxProfit(int k, vector<int>& prices) {

if (prices.size() == 0) return 0;

vector<vector<int>> dp(prices.size(), vector<int>(2 * k + 1, 0));

for (int j = 1; j < 2 * k; j += 2) {

dp[0][j] = -prices[0];

}

for (int i = 1;i < prices.size(); i++) {

for (int j = 0; j < 2 * k - 1; j += 2) {

dp[i][j + 1] = max(dp[i - 1][j + 1], dp[i - 1][j] - prices[i]);

dp[i][j + 2] = max(dp[i - 1][j + 2], dp[i - 1][j + 1] + prices[i]);

}

}

return dp[prices.size() - 1][2 * k];

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

Of course, some solutions define a three-dimensional array dp[i][j][k], representing i-th day, j-th transaction, state of buying or selling, which is relatively intuitive by definition. However, operating on a three-dimensional array feels cumbersome, so directly using a two-dimensional array to simulate the three-dimensional array situation makes the code cleaner.

# Best Time to Buy and Sell Stock with Cooldown

Dynamic Programming: 0309.Best Time to Buy and Sell Stock with Cooldown (opens new window) allows multiple trades but each sell has a cooldown period of one day.

Compared with Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window), this problem adds a cooldown period.

In Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window), there are two states, cash after holding a stock, and cash after not holding a stock. In this problem, we can have four states.

dp[i][j] means the maximum cash left on day i when the state is j.

Specifically, it can be divided into the following four states:

- State 1: Buy stock state (Today buys stock, or it was already bought before and then no operation)

- Sell stock state, there are two kinds of sell stock states:

- State 2: Sold stock two days ago, passed the cooldown period, always no operation, today keeps the sell stock state

- State 3: Sold stock today

- State 4: Today is cooldown state, but cooldown state is not sustainable, only one day!

Reaching the buy stock state (State 1) is dp[i][0], there are two specific operations:

- Operation one: holding stock state (State 1) on the previous day,

dp[i][0] = dp[i - 1][0] - Operation two: bought today, two situations:

- Cooldown state (State 4) the previous day,

dp[i - 1][3] - prices[i] - Maintaining sell stock state (State 2) the previous day,

dp[i - 1][1] - prices[i]

- Cooldown state (State 4) the previous day,

So operation two takes the maximum value, i.e., max(dp[i - 1][3], dp[i - 1][1]) - prices[i]

Then dp[i][0] = max(dp[i - 1][0], max(dp[i - 1][3], dp[i - 1][1]) - prices[i]);

Reaching the keep selling stock state (State 2) is dp[i][1], there are two specific operations:

- Operation one: it is state two on the previous day

- Operation two: it is cooldown state (State 4) on the previous day

dp[i][1] = max(dp[i - 1][1], dp[i - 1][3]);

Reaching the sell stock today state (State 3) is dp[i][2], there is only one operation:

- Operation one: It must be bought stock state (State 1) the day before, sell today

i.e., dp[i][2] = dp[i - 1][0] + prices[i];

Reaching the cooldown state (State 4) is dp[i][3], there is only one operation:

- Operation one: Sold stock (State 3) yesterday

dp[i][3] = dp[i - 1][2];

Summarizing the above analysis, the recurrence code is as follows:

dp[i][0] = max(dp[i - 1][0], max(dp[i - 1][3], dp[i - 1][1]) - prices[i];

dp[i][1] = max(dp[i - 1][1], dp[i - 1][3]);

dp[i][2] = dp[i - 1][0] + prices[i];

dp[i][3] = dp[i - 1][2];

2

3

4

The overall code is as follows:

class Solution {

public:

int maxProfit(vector<int>& prices) {

int n = prices.size();

if (n == 0) return 0;

vector<vector<int>> dp(n, vector<int>(4, 0));

dp[0][0] -= prices[0]; // Hold stock

for (int i = 1; i < n; i++) {

dp[i][0] = max(dp[i - 1][0], max(dp[i - 1][3], dp[i - 1][1]) - prices[i]);

dp[i][1] = max(dp[i - 1][1], dp[i - 1][3]);

dp[i][2] = dp[i - 1][0] + prices[i];

dp[i][3] = dp[i - 1][2];

}

return max(dp[n - 1][3], max(dp[n - 1][1], dp[n - 1][2]));

}

};

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

- Time Complexity: O(n)

- Space Complexity: O(n)

# Best Time to Buy and Sell Stock with Transaction Fee

Dynamic Programming: 0714.Best Time to Buy and Sell Stock with Transaction Fee (Dynamic Programming) (opens new window) allows multiple trades but each has a transaction fee.

Compared with Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window), this question only needs to subtract the transaction fee in the calculation of the sell operation, and the code is almost the same.

The only difference lies in the recurrence formula part, so this article won't elaborate in detail according to the dynamic programming five-step framework, mainly explaining the recurrence formula.

Here restate the meaning of the dp array:

dp[i][0] means the maximum cash remaining on day i when holding a stock.

dp[i][1] means the maximum cash obtained without holding a stock on day i.

If holding the stock on day i, i.e., dp[i][0], it can be derived from two states:

- Holding the stock on day i-1, that means keep the status quo, and the cash obtained is the cash from holding the stock yesterday:

dp[i - 1][0] - Buy the stock on day i, the cash obtained is the cash from not holding the stock yesterday minus the stock price today:

dp[i - 1][1] - prices[i]

So: dp[i][0] = max(dp[i - 1][0], dp[i - 1][1] - prices[i]);

Now consider the situation if not holding the stock on day i, i.e., dp[i][1]. It can also be derived from two states:

- Not holding the stock on day i-1, that means keep the status quo, and the cash obtained is the cash from not holding the stock yesterday:

dp[i - 1][1] - Sell the stock on day i, the cash obtained is the cash from selling the stock at today's price, note that a transaction fee is needed here:

dp[i - 1][0] + prices[i] - fee

So: dp[i][1] = max(dp[i - 1][1], dp[i - 1][0] + prices[i] - fee);

The difference between this problem and Dynamic Programming: 0122.Best Time to Buy and Sell Stock II (Dynamic Programming) (opens new window) is the need to subtract a transaction fee.

Above analysis completed, the code is as follows:

class Solution {

public:

int maxProfit(vector<int>& prices, int fee) {

int n = prices.size();

vector<vector<int>> dp(n, vector<int>(2, 0));

dp[0][0] -= prices[0]; // Hold stock

for (int i = 1; i < n; i++) {

dp[i][0] = max(dp[i - 1][0], dp[i - 1][1] - prices[i]);

dp[i][1] = max(dp[i - 1][1], dp[i - 1][0] + prices[i] - fee);

}

return max(dp[n - 1][0], dp[n - 1][1]);

}

};

2

3

4

5

6

7

8

9

10

11

12

13

- Time Complexity: O(n)

- Space Complexity: O(n)

# Conclusion

So far, the stock series has officially ended, and all have been fully explained!

From trading once to multiple trades, from trading up to twice to trading up to k times, from cooldown to transaction fee, finally coming to a great stock summary, this perfectly concludes the stock series.

The "Code Thoughts" is worth recommending to every friend and colleague learning algorithms, and those who follow it will find it a late encounter!